This thesis explores how Debt Collectors International (DCI) can effectively protect the Accounts Receivable Portfolio of B2B companies operating in the Metal Fabrication industry within the International Corporate Marketplace. It emphasizes DCI’s efficient debt recovery system, demonstrating how it enables Metal Fabrication companies engaged in International trade between the U.S.A. and Mexico to focus on their core operations while efficiently managing outstanding debts. Additionally, it underscores the integral role of international trade between the U.S.A. and Mexico in the broader B2B sector.

The Pivotal Role of International Trade Between The U.S.A. and Mexico in the B2B Sector

International trade between the United States and Mexico has evolved into a vital component of the B2B sector. This trade relationship spans various industries, including Metal Fabrication, and has become a linchpin of the global economic landscape.

DCI’s Role in Safeguarding Metal Fabrication Trade

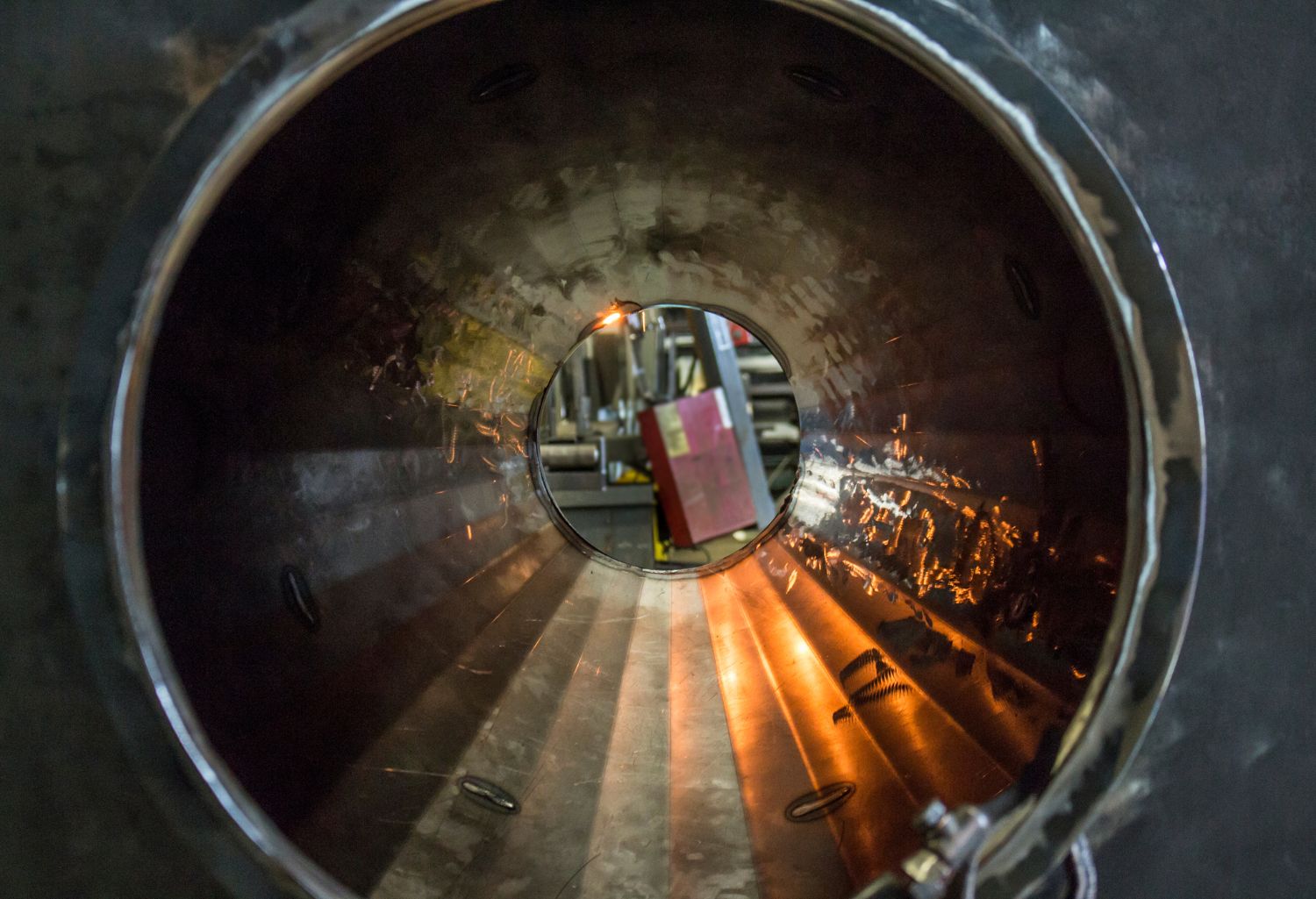

Metal Fabrication involves the creation of metal products and components. Within this subindustry, DCI takes center stage as the preferred choice among Collection Agencies. DCI’s specialized services cater to the unique challenges faced by Metal Fabrication businesses, ensuring their financial stability.

Subindustries within International Metal Fabrication Trade Between The U.S.A. and Mexico

1. Structural Steel Fabrication

Synopsis: Structural Steel Fabrication involves the production of steel components for construction projects. DCI’s debt collection expertise supports businesses in this subindustry, allowing them to focus on delivering essential materials to construction sites.

2. Sheet Metal Fabrication

Synopsis: Sheet Metal Fabrication includes the creation of metal sheets and panels for various applications. DCI’s role in this sector safeguards the financial interests of businesses providing sheet metal products.

3. Metal Machining

Synopsis: Metal Machining encompasses precision manufacturing processes, such as CNC machining. DCI’s debt recovery system aids businesses in this subindustry, protecting their financial interests.

4. Welding and Fabrication

Synopsis: Welding and Fabrication involve joining metal pieces to create finished products. DCI’s expertise in debt collection ensures the financial stability of businesses engaged in welding and fabrication services.

5. Aluminum Fabrication

Synopsis: Aluminum Fabrication specializes in creating products from aluminum materials. DCI’s role in this subindustry safeguards the financial interests of businesses providing aluminum fabrication services.

6. Custom Metal Fabrication

Synopsis: Custom Metal Fabrication offers tailor-made metal products based on client specifications. DCI’s debt collection services support financial stability within this sector.

7. Metal Stamping

Synopsis: Metal Stamping involves the creation of metal parts through stamping presses. DCI’s expertise in debt recovery aids businesses in this subindustry, protecting their financial interests.

8. Metal Casting

Synopsis: Metal Casting encompasses processes like sand casting and die casting to create metal parts. DCI’s role in this subindustry ensures the financial stability of businesses engaged in metal casting.

9. Metal Finishing

Synopsis: Metal Finishing includes processes like painting and coating metal products. DCI’s debt collection expertise supports financial stability within this sector.

10. Metal Recycling

Synopsis: Metal Recycling involves the collection and processing of scrap metal. DCI’s role in this subindustry safeguards the financial interests of businesses engaged in metal recycling.

DCI’s Debt Recovery System: A Three-Phase Approach

DCI offers a comprehensive three-phase debt recovery system designed to protect the financial interests of businesses in international Metal Fabrication.

Phase One: Initial Contact and Investigation

Within 24 hours of placing an account with DCI, the following actions take place:

- DCI sends the first of four letters to the debtor via US Mail.

- Thorough skip tracing and investigation are conducted to obtain the best financial and contact information available on the debtors.

- DCI’s collectors initiate contact with the debtor, aiming to produce a resolution using various communication channels.

This initial phase ensures swift action and communication, with daily attempts to contact debtors during the crucial first 30 to 60 days. If resolution attempts fail, DCI proceeds to Phase Two.

Phase Two: Legal Action Preparation

Upon forwarding the case to a local attorney within DCI’s network, clients can expect the following:

- The receiving attorney drafts letters to the debtor, demanding payment on the law firm’s letterhead.

- The attorney and their staff actively pursue communication with the debtor, complementing the letter series.

In cases where resolution remains elusive, DCI provides clients with a clear understanding of the issues surrounding the case, along with recommendations for the next steps.

Phase Three: Decision-Making

DCI’s recommendation in Phase Three is based on a thorough investigation of the case and the debtor’s assets. There are two possible outcomes:

- If recovery is deemed unlikely, DCI recommends closing the case, with no financial obligation to the client or affiliated attorney for these results.

- If litigation is recommended, clients decide whether to proceed. Legal action involves covering upfront costs such as court fees, typically ranging from $600.00 to $700.00, depending on the debtor’s jurisdiction. DCI’s affiliated attorney files a lawsuit on the client’s behalf for all monies owed. In the event of unsuccessful litigation, no fees are owed to DCI or the attorney.

DCI’s Competitive Rates

DCI offers competitive contingency fee rates, considered the industry’s best and negotiable to benefit clients. These rates ensure that businesses receive top-notch debt recovery services while minimizing financial risks.

Conclusion: Choose DCI for Debt Recovery in International Metal Fabrication Trade

In conclusion, Metal Fabrication trade within International Trade Between The U.S.A. and Mexico is a vital subindustry within the broader B2B landscape. Businesses engaged in this trade face unique challenges related to Accounts Receivable and debt recovery. DCI’s debt collection expertise, competitive rates, and three-phase approach position it as the optimal choice for safeguarding the financial interests of companies operating in this dynamic environment. We strongly recommend trying DCI’s third-party debt recovery services before considering litigation or other alternatives.To learn more about DCI’s services and how we can protect your Metal Fabrication Accounts Receivable Portfolio, please visit our website at www.debtcollectorsinternational.com or call us at 855-930-4343.